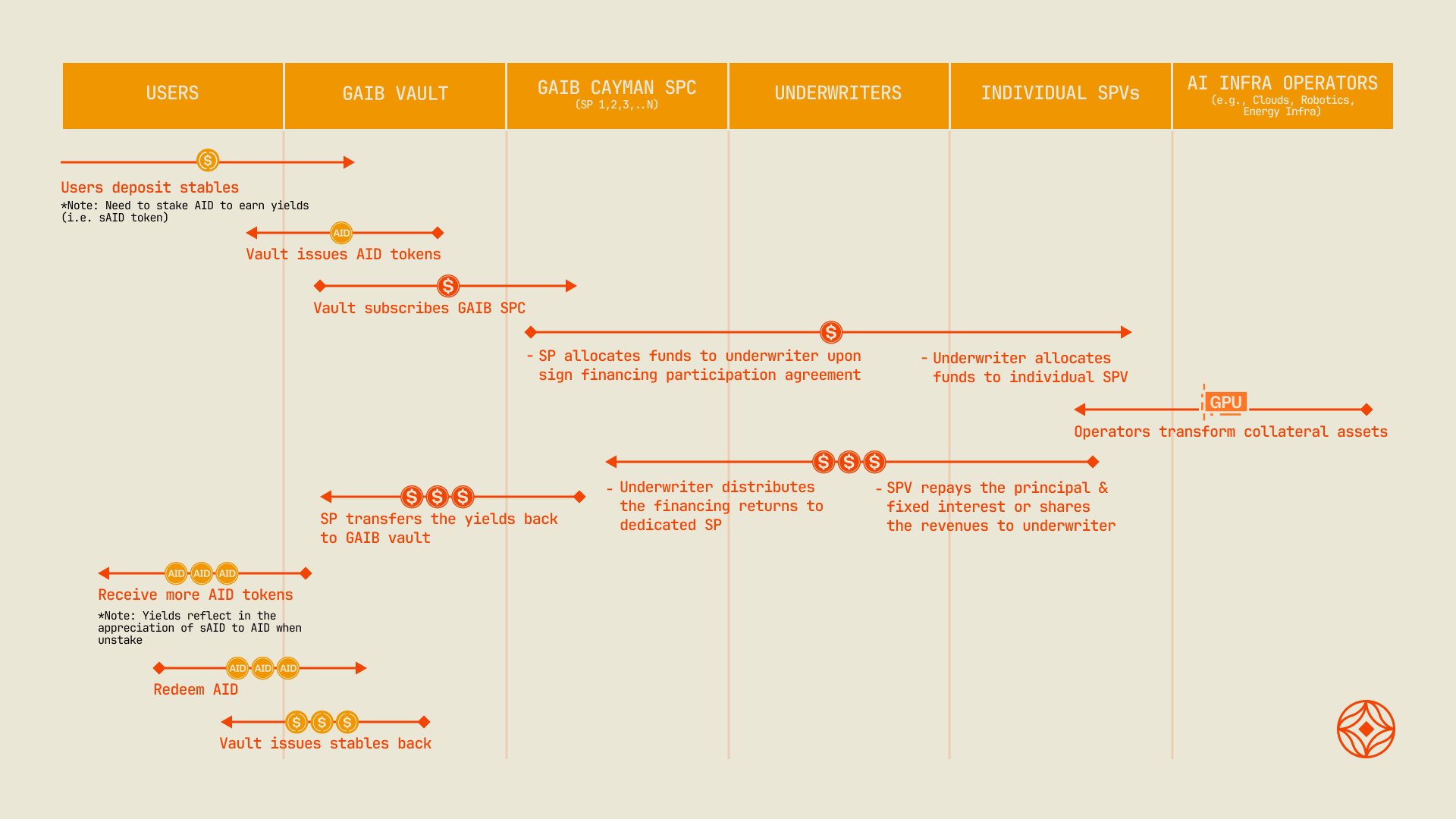

Flow of Funds

Financing deals 1, 2, 3, … N

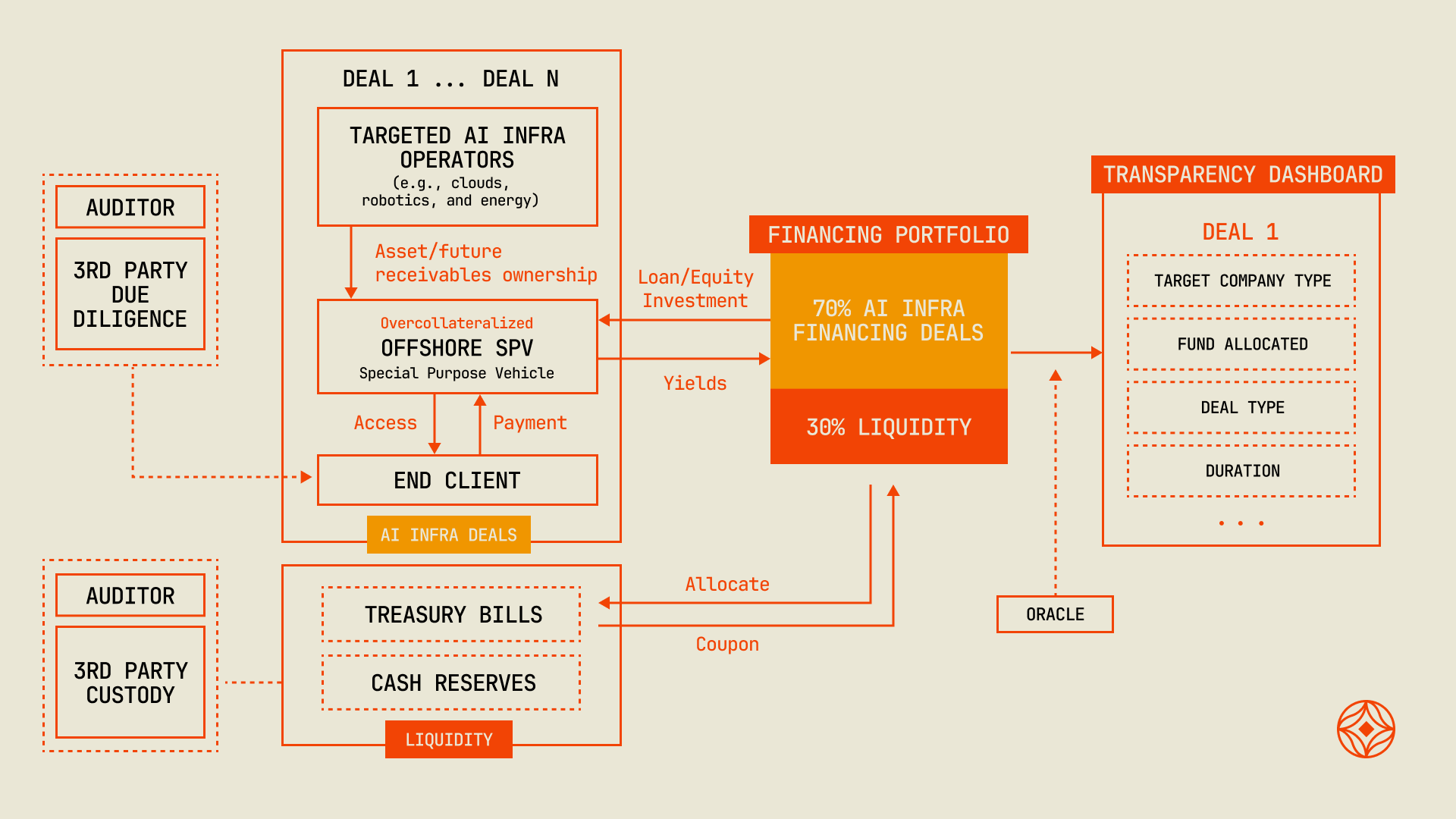

Section titled “Financing deals 1, 2, 3, … N”GAIB allocates approximately 70% of funds to structure AI infra financing deals with reputable cloud operators, robotics companies worldwide, backed by physical GPU clusters, robotics hardware and their associated service contract. The remaining 30% is allocated to the U.S. Treasuries and cash reserves, serving as a liquidity buffer.

- Financing deal types:

- Debt model: The SPV (“borrower” ) formed and managed by the targeted AI infra operator pays fixed interests on the borrowed capital. (Estimated 10% ~ 20% APY)

- Equity model: The SPV (“Investee” ) formed and managed by the targeted AI infra operator pays a revenue share of the GPUs. (Estimated 60% ~ 80% APY)

- Hybrid model: Combine both

- Collateral Requirements

- All agreements are backed by physical enterprise-grade GPUs like NVIDIA H100s, H200s, GB200s, or robotics hardware etc.

- Maturity:

- Depending on deal structuring, maturity can range from 3 months (e.g. bridge financing) to 3 years. Given the short payback period of enterprise-grade GPUs due to the high demand, GPU backed loans could have much shorter maturity than typical debt.

- Risk Management

- GAIB conducts stringent due diligence according to the Credit Analysis framework and work with 3rd party auditors when necessary

- All agreements are over-collateralized by the GPU or robotics hardware assets

- Bankruptcy-remote structure is applied, the GPU / robotics assets and their future cash flows (e.g. from the leasing contracts) are held in a separate legal entity—often a Special Purpose Vehicle (SPV).

- In case of default, GAIB has the authority to liquidate the underlying assets to pay back the investors, or continue to host and manage the GPUs or robotics using GAIB’s strategic partners’ facilities to keep on generating revenue for investors.

- Strategic Collaboration with Decentralized Compute

- GAIB partners up with decentralized compute protocols to tokenize the on-chain revenue streams of compute providers on different de-compute platforms, starting with Aethir. (details)

- Third Party

- GAIB works with third-party auditors, credit underwriters, and other professional service providers when necessary, to maximize investor protection and risk-reward of each GPU financing deals.