GAIB Protocol - Economic Layer For AI Infrastructure

Layers Overview

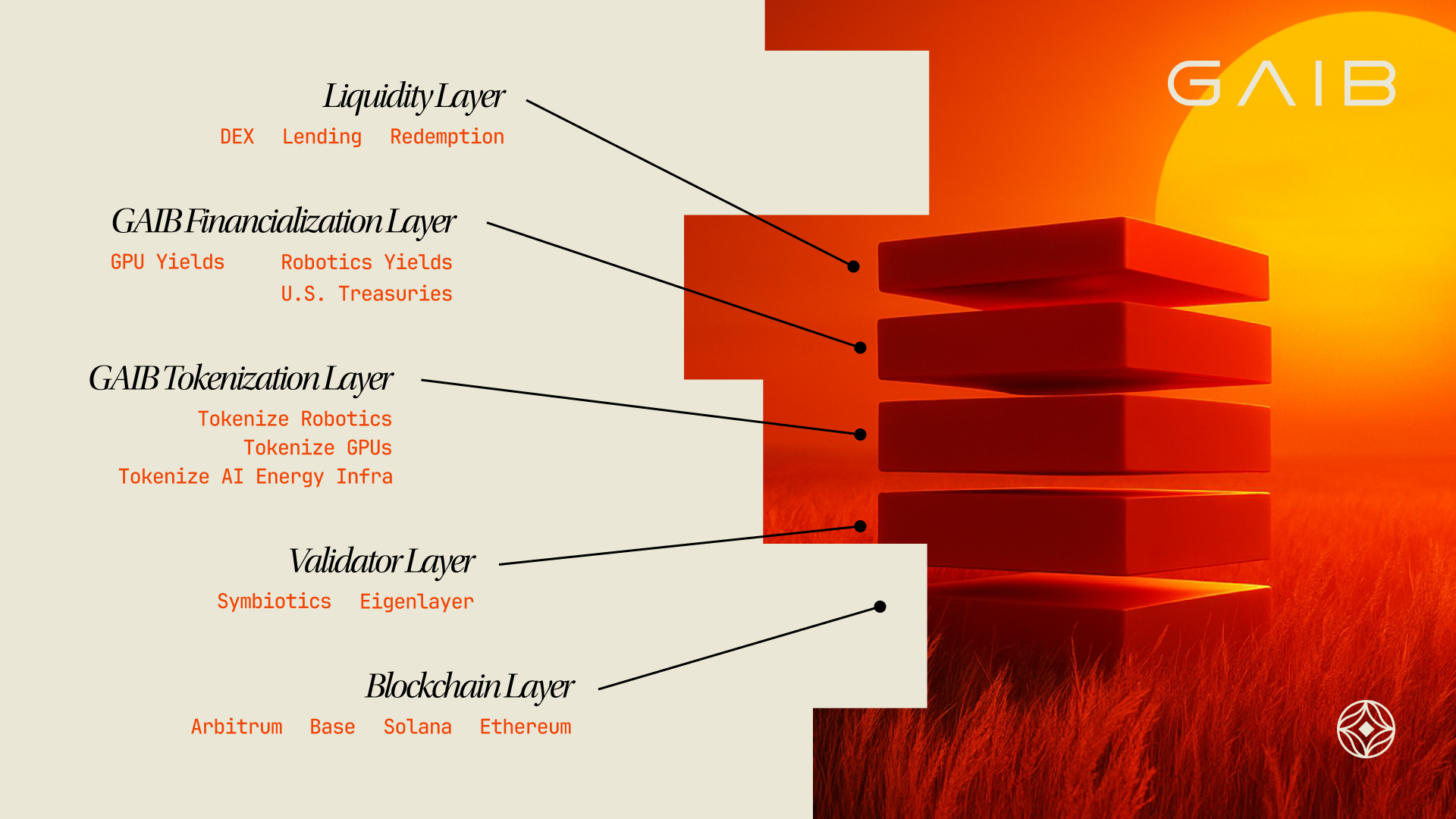

Section titled “Layers Overview”The GAIB protocol integrates a multi-layer architecture to bridge blockchain and real-world AI infrastructure:

- Blockchain Layer: Built on Ethereum, Solana, Base, and Arbitrum, providing secure, decentralized settlement and smart contract execution.

- Tokenization Layer: Converts physical AI infrastructure assets—such as robotics, GPUs, and AI energy infra—into on-chain tokens, enabling fractional ownership and interoperability.

- Financialization Layer: Transforms tokenized assets into yield-generating instruments, including returns from financing deals, as well as low-risk instruments like U.S. Treasury.

- Liquidity Layer: Ensures efficient capital movement and market access through mechanisms such as redemption, lending, and trading on leading DEXes.

Tokenization Layer: ONRAMP

Section titled “Tokenization Layer: ONRAMP”GAIB’s ONRAMP (On-Chain Real World Asset Minting Protocol) is a structured pathway that transforms real-world AI infrastructure — from GPUs to robotics to datacenter systems — into blockchain-native financial instruments. Capital flows from investors into GAIB’s Vault, which allocates funds into segregated portfolios (SPs) within a Cayman SPC. These portfolios participate in a range of financings — credit, equity, and mezzanine — originated and structured by Underwriters for AI infrastructure providers. The framework is designed to be bankruptcy-remote, legally enforceable, and institutionally credible while unlocking the efficiency and programmability of DeFi.

At the heart of ONRAMP is tokenization. Each SP’s position — whether secured debt, equity, or mezzanine exposure — is minted into digital tokens through GAIB’s Tokenization Engine. These tokens, called sAID, represent exposure in the underlying structured positions, fully collateralized or contractually supported by AI infrastructure. Credit enhancements such as overcollateralization, cash reserves, and credit insurance apply to debt tranches, while equity and mezzanine tokens are structured for upside participation. This creates a flexible but standardized way for investors to hold, trade, or redeem exposures across the capital stack.

By converting physical AI infrastructure into digital assets, ONRAMP builds the bridge between real-world AI assets and blockchain finance. Robotics fleets, GPU clusters, and datacenter assets can be financed, securitized, and tokenized into sAID, which flow back into the GAIB Vault and into investor wallets. This not only brings liquidity, transparency, and composability to traditionally illiquid asset classes but also creates a unified platform for investors to access the full capital stack of AI infrastructure.

Financial Layer: YIELD

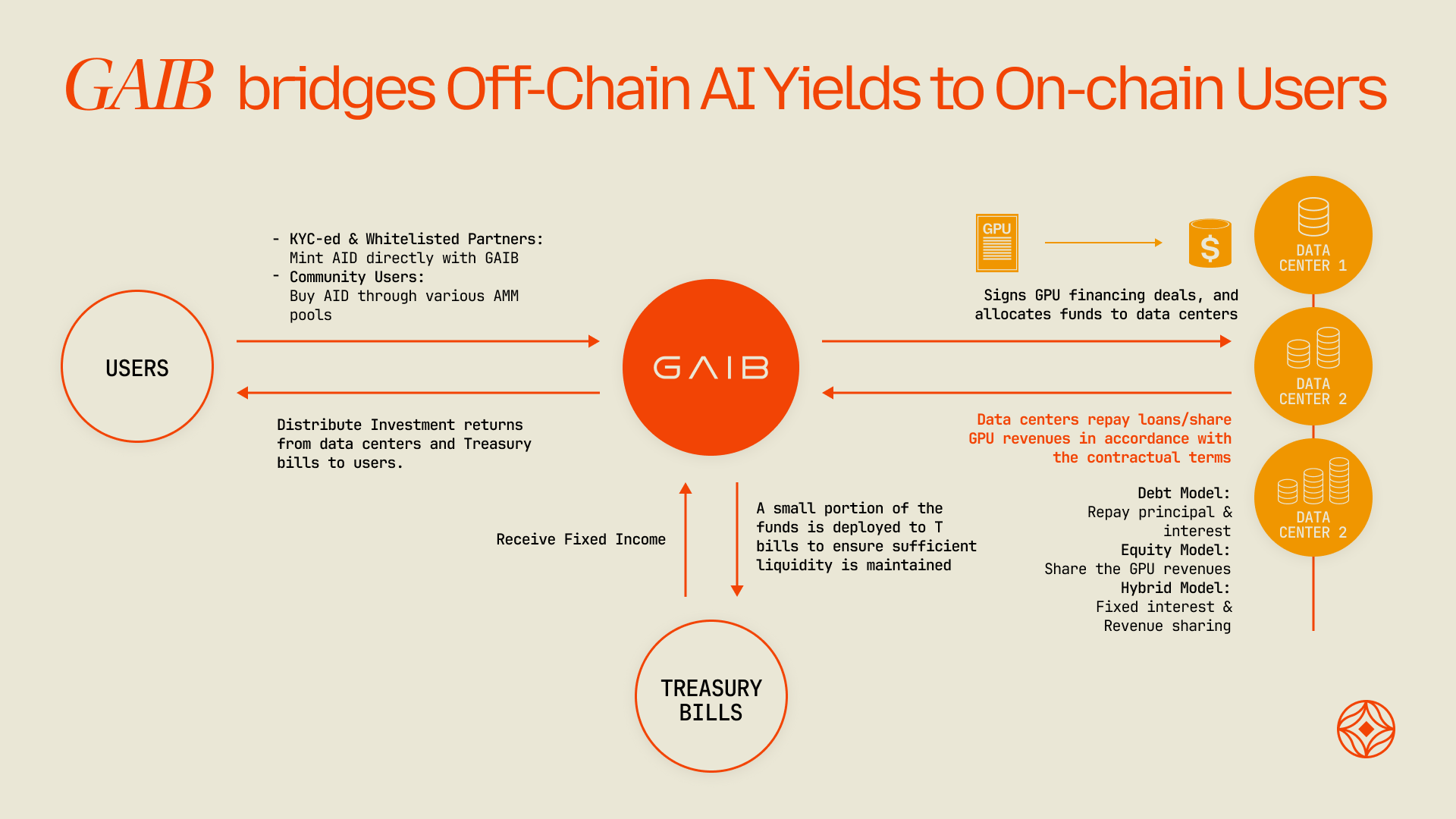

Section titled “Financial Layer: YIELD”At the financial layer, GAIB transforms real-world AI infra assets — such as enterprise-grade GPUs or robotics hardware financing deals — into a fund token - sAID.

AID is built on LayerZero’s omnichain fungible token (OFT) standard, these assets gain cross-chain liquidity and accessibility. sAID functions like holding a fund token; in other words, sAID represents a proportional share of GAIB’s investment portfolios, with its value appreciating as returns from the protocol’s investments accrue.

GAIB’s default strategy allocates capital into diversified AI data center financing opportunities alongside a reserve of the U.S. Treasury bills.

Example: Data Center Financing Deals

Beyond the core strategy, GAIB also offers thematic investment products — from robotics-focused portfolios to deal-specific vaults — enabling investors to gain targeted exposure to AI-driven cash flows while participating in the broader DeFi ecosystem.

GAIB’s Financing Models

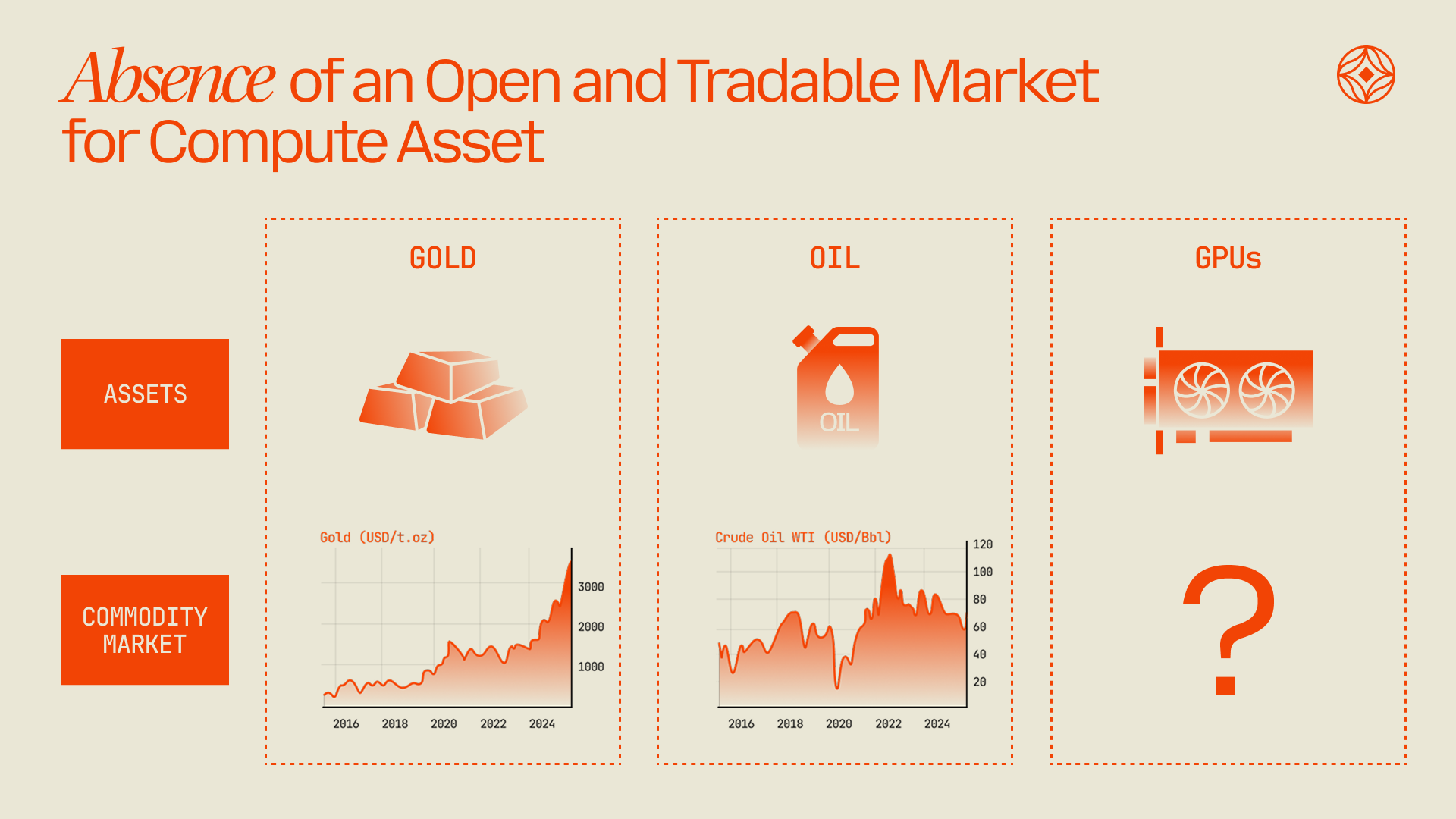

Section titled “GAIB’s Financing Models”As AI continues to advance, the demand for computing power has surged—yet traditional financing methods like bank loans and PE/VC funding come with significant limitations, including lengthy approval processes and high capital costs. These constraints create funding bottlenecks for data centers, preventing them from scaling compute capacity fast enough to meet growing AI demand.

GAIB responds by offering three tailored financing models to address diverse capital needs, including Debt model with fixed interest repayments; Equity model sharing future GPU-generated revenue, and Hybrid model combining both structures.

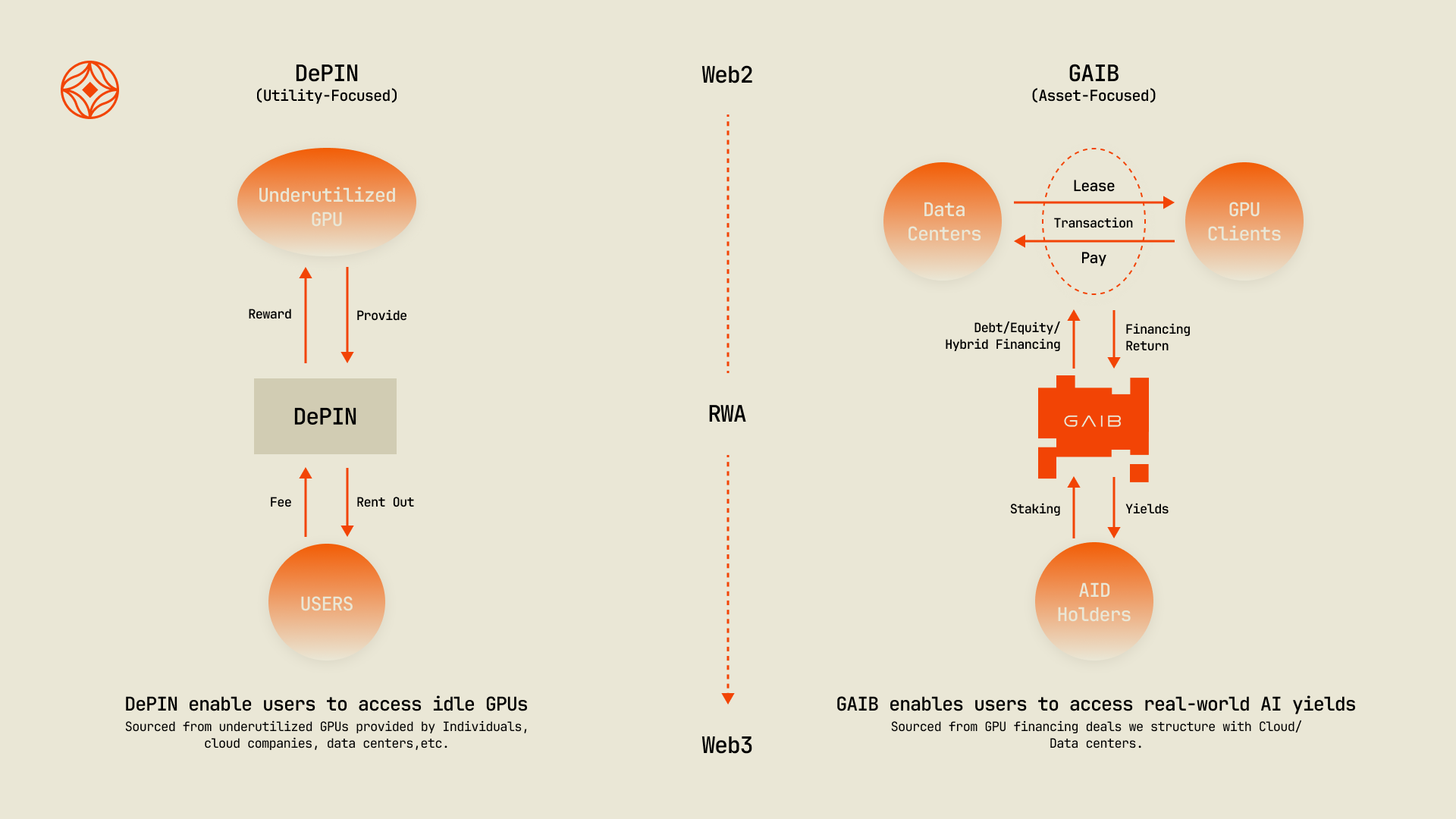

| Note: GAIB is not an utility-DePIN project. While DePIN compute protocols—such as Aethir, io.net, and Render—focus on the utility side, aiming to distribute access to underutilized GPUs for computational use, therefore maximizing its utility, in contrast, GAIB is building a financial layer for GPU assets, transforming them into tradable and yield-generating instruments accessible to all. |

|---|

Liquidity Layer: NEXUS

Section titled “Liquidity Layer: NEXUS”At the liquidity layer, GAIB integrates AID and its liquid staking token (LST) - sAID deeply into the DeFi ecosystem, enabling users to stake, lend/borrow, and trade on secondary markets, thereby enhancing liquidity and utility. Users can seamlessly convert between AID and sAID, allowing flexible adjustments according to their risk appetite and liquidity needs. Additionally, AID can be exchanged for supported stablecoins such as USDC and USDT, facilitating easy capital entry and exit.

The redemption process combines periodic cycle-based redemptions with an on-chain auction mechanism to balance liquidity and market stability, preventing abrupt price shocks from mass redemptions.

Looking ahead, GAIB plans to launch options, futures, and other structured financial products to enrich AID’s utility and provide investors with advanced tools for risk management and yield optimization.

To safeguard investor interests, GAIB maintains the ASP — a dedicated protocol insurance and reinsurance fund designed to mitigate default and operational risks, ensuring the overall resilience and stability of the AI infrastructure capital markets.

Validator Network (Security & Trust): NETWORK

Section titled “Validator Network (Security & Trust): NETWORK”GAIB Validator Network secures and validates relayers that enable cross-chain transactions, by leveraging shared-security restaking mechanisms from EigenLayer’s AVS and Symbiotic. This framework is essential for safeguarding assets and ensuring seamless, trustless interoperability across multiple blockchains.

Blockchains

GAIB operates on an omnichain architecture, seamlessly supporting multiple blockchains including Ethereum, Arbitrum, Base, and others.