What Problems Are We Solving?

A Little Background About GPUs, Compute, and Why AI Needs Them

Section titled “A Little Background About GPUs, Compute, and Why AI Needs Them”

A GPU (Graphics Processing Unit) is a type of processor originally built for rendering images and video, but now widely used for high-performance computing (HPC) and AI workloads, thanks to its unmatched capacity for massive parallel processing. On the supply side, Nvidia dominates today’s GPU market, holding 92% of total market share in Q1 2025. Its enterprise-grade GPU product lineup includes the H100 and H200, built on the Hopper architecture, and the latest B200 and B300 based on the Blackwell architecture.

Similar to car engines that create kinetic forces to move vehicles forward, GPUs create Compute Power, which is essential to train and run AI foundation models (FMs), such as the latest GPT 5 and Llama 4. The more compute power, the smarter and faster those AI models can be built and operated. The FMs training process requires tens of thousands of enterprise-grade GPUs (e.g., H200s, B200s) running continuously for months. Without compute power, training smart AI models and running them are impossible.

In short: GPUs create compute power, which trains and runs AI. No compute, no AI.

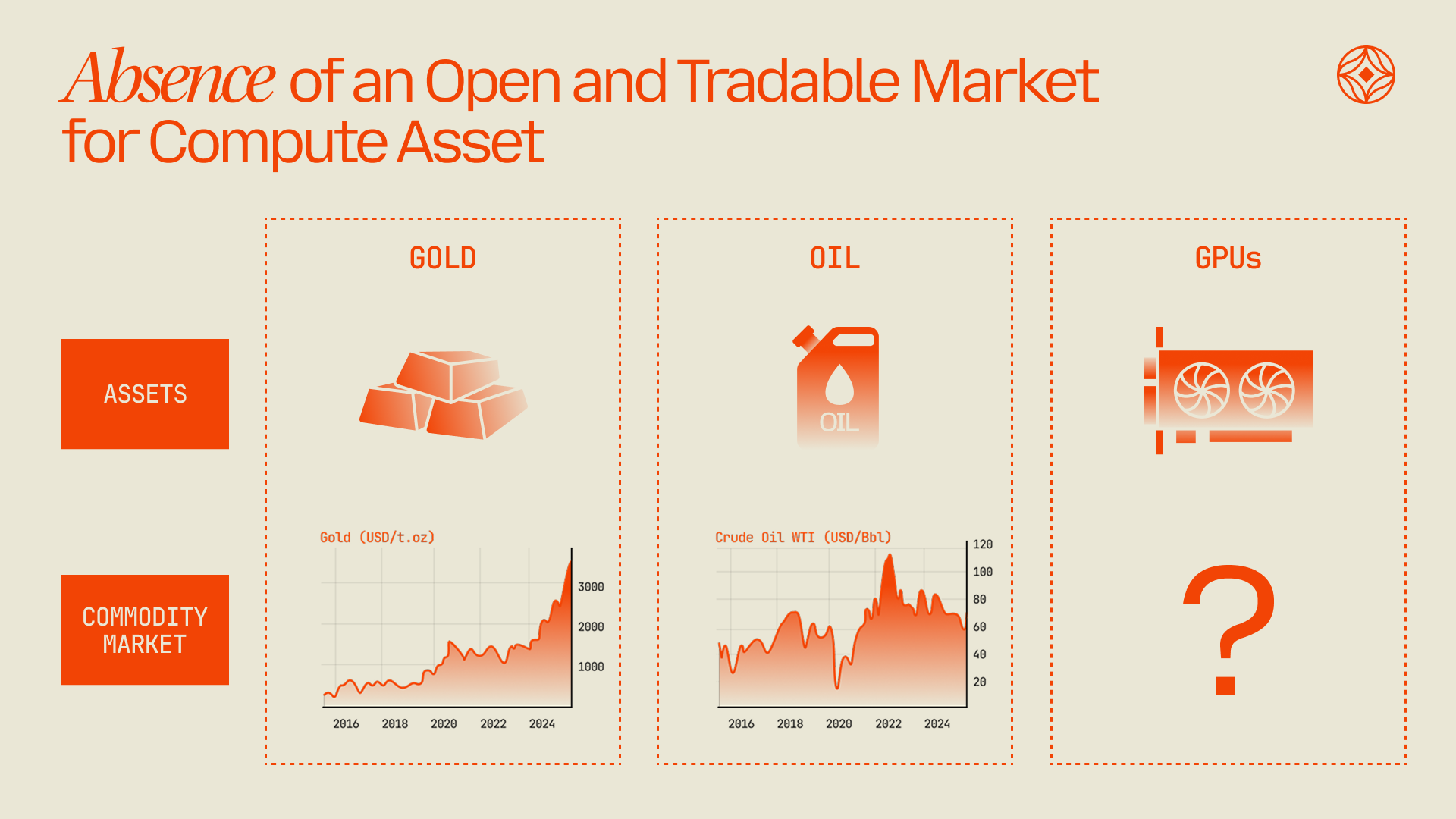

1. Absence of a Liquid Compute Asset Market

Section titled “1. Absence of a Liquid Compute Asset Market”In the AI era, quoting Sam Altman, “compute will be the currency of the future”. In other words, enterprise-grade GPUs can be viewed as a new class of commodities. Let’s take gold, the physical commodity we are more familiar with as an example. Before the advent of modern futures trading (1970s) and the first major gold ETFs (early 2000s), gold’s total market value was only in the low trillions. Today, driven by transparent markets and easy investor access, gold’s global market cap has soared above $22.5 trillion. Compute as commodities is like gold before the 1970s, lacking a liquid, transparent, and efficient market. Compute assets such as enterprise-grade GPUs are in extremely high demand but cannot be traded or leveraged effectively, limiting their economic value proposition.

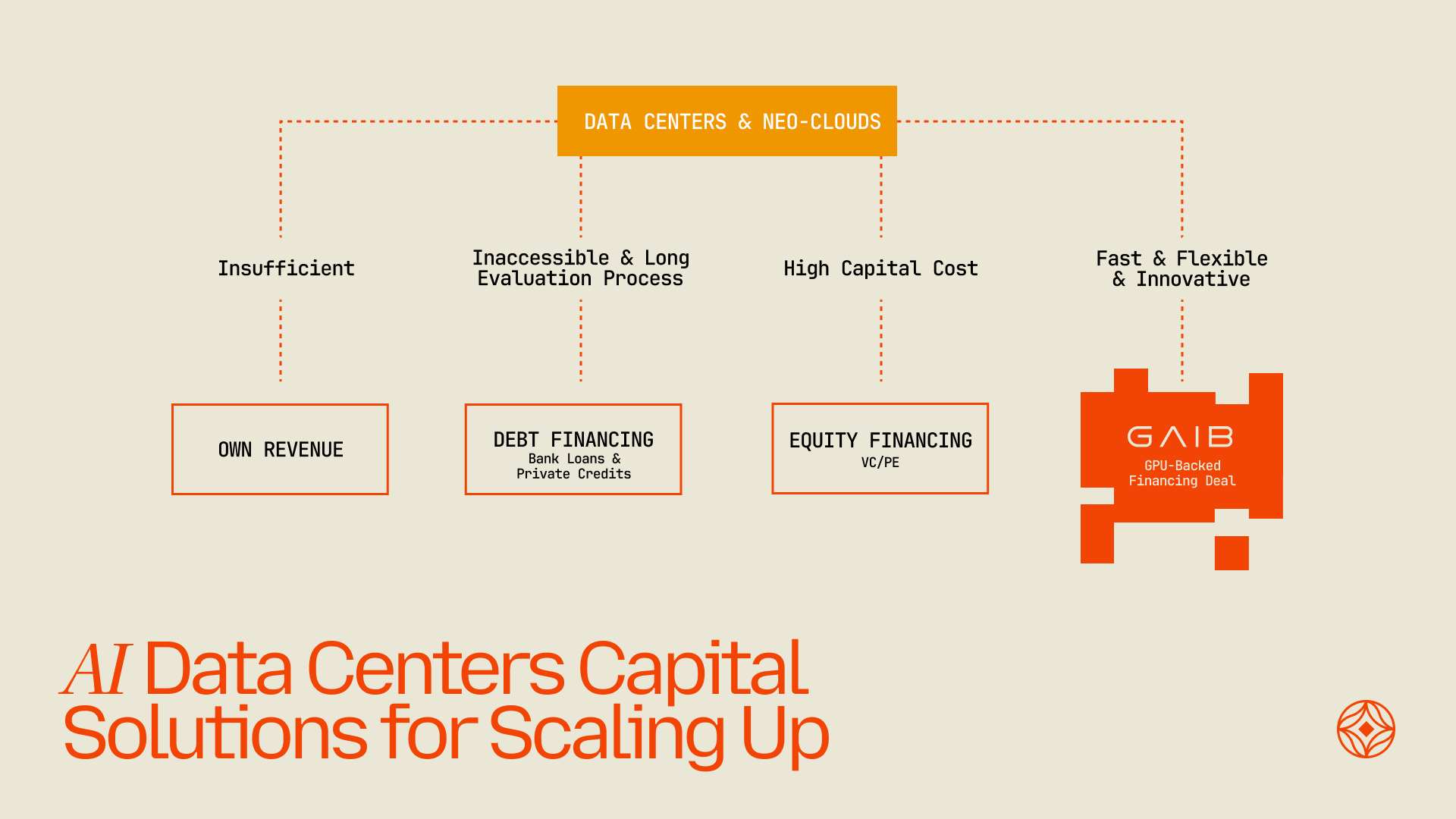

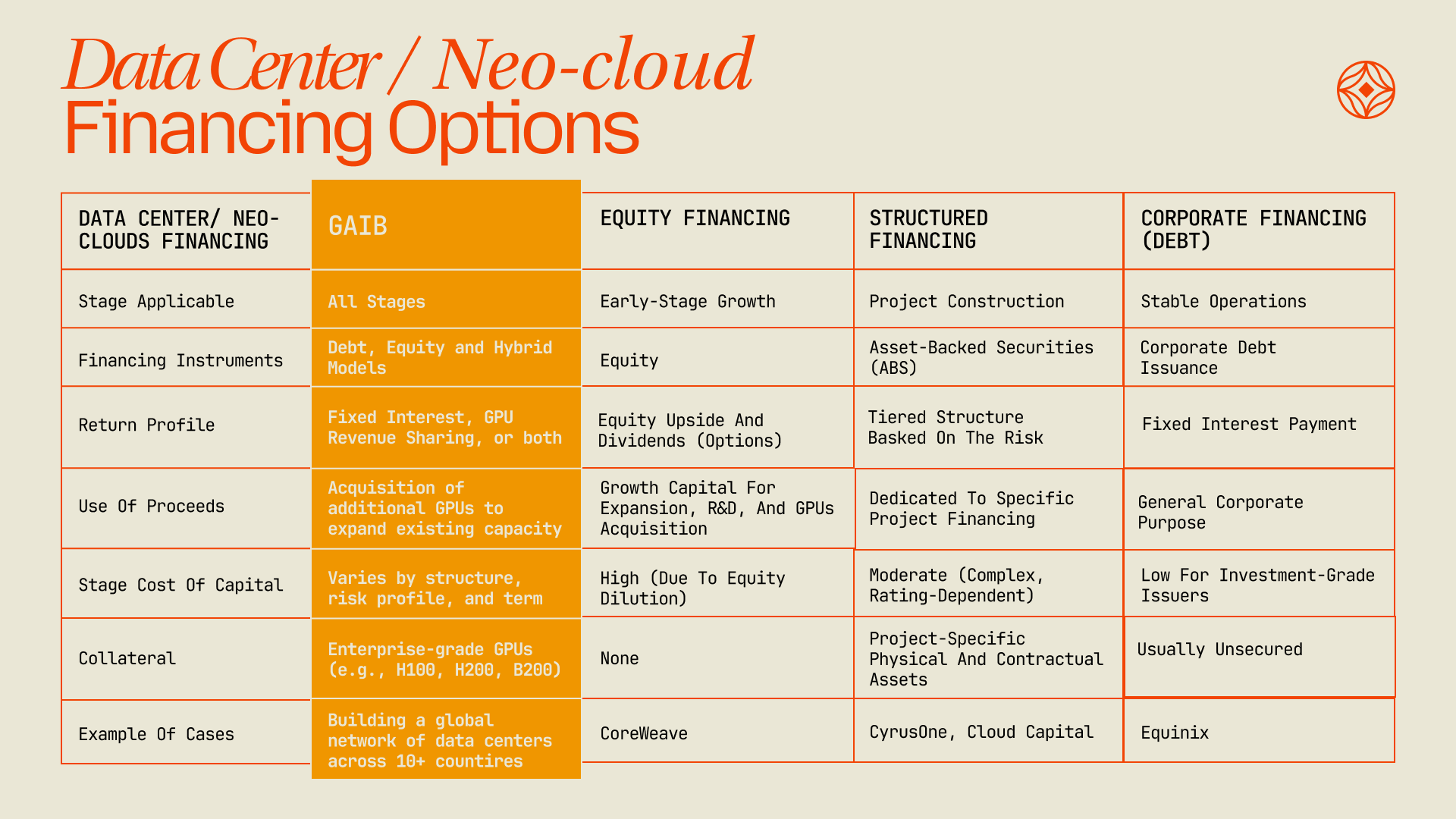

2. Capital Barriers for Cloud / Data Centers

Section titled “2. Capital Barriers for Cloud / Data Centers”Cloud / data centers—which collectively house trillions of dollars’ worth of compute assets—are essential to delivering the raw processing power that underpins modern AI. Yet they are also among the most capital-intensive businesses in tech, with the leading cloud service providers (AWS, Azure, Google Cloud) investing tens of billions of dollars annually in data center construction, networking infrastructure, and high-performance GPUs. A single NVIDIA H200 card can cost upwards of $30,000, and outfitting a large-scale facility can quickly escalate into the hundreds of millions. As demand for AI workloads grows exponentially, the need to finance and refinance these expensive expansions becomes a critical bottleneck—one that, without innovative financing solutions, could limit how quickly the cloud / data centers can scale to meet the world’s computing needs.

3. Lack of Real Yields & Real Assets in the Crypto Space

Section titled “3. Lack of Real Yields & Real Assets in the Crypto Space”The crypto sector faces a significant challenge: a shortage of real-yield assets. Many of the high returns advertised in crypto rely on token inflation, which isn’t sustainable over the long term. Although many innovative projects aim to bring real-world returns into the space, they often involve hurdles like strict KYC requirements, lock-up periods that reduce liquidity, or ongoing trust and security concerns. As a result, RWA solutions have gained only modest traction, with on-chain T-bills serving as the primary example of genuine yield.

This lack of secure, liquid, and high-yielding real-world assets on-chain makes it harder for the industry to attract long-term capital and integrate more deeply with traditional finance. Without better, more accessible real-yield options, crypto risks remaining dependent on inflation-based rewards, which can undermine both its credibility and its future growth.

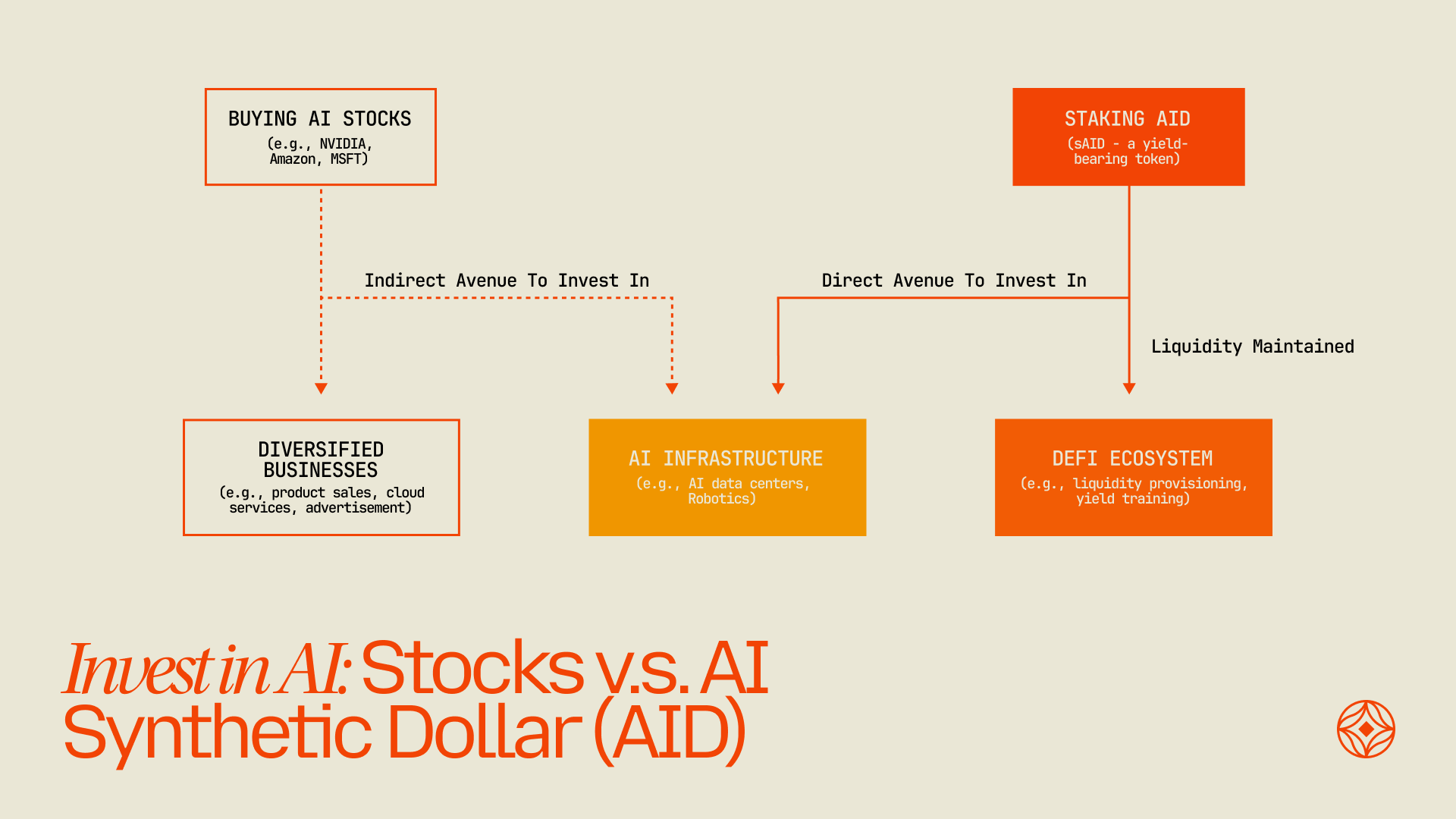

4. Vacuum in Direct Channels for AI Investments

Section titled “4. Vacuum in Direct Channels for AI Investments”Compute captures the majority of value in the AI supply chain. For large AI projects, spend on compute can be a substantial fraction of total cost—often cited anywhere from 30% to 60% of the overall operational spend for AI (covering both training and inference). Major chipmakers such as NVIDIA had gross margins as high as 72.7% in 2024, while its data centers segment revenue reached $35.6 billion in Q4 2024, representing 90.6% of the total revenue. The global cloud compute sector has the size of more than $600 billion in annual revenue as of 2024, with a compound annual growth rate (CAGR) of 12-18% over the next five years.

However, for individual and institutional investors, the options to participate in such a substantial, high growth, and high margin sector are relatively limited. Beyond purchasing AI-related stocks like NVIDIA, there are very few avenues to directly invest in the compute assets that drive the AI revolution.

Why GAIB Matters to Data Center/ Neo-cloud

Section titled “Why GAIB Matters to Data Center/ Neo-cloud”

- Faster and More Flexible Funding Data centers often face capital restraint to acquire high-performance GPUs and expand infrastructure to scale faster and meet soaring demand. GAIB’s platform removes many of the obstacles tied to conventional financing—lengthy approval processes, high interest rates, and rigid terms—by transforming GPUs and their future cash flows into fund tokens. This streamlined approach provides swift access to capital, allowing data centers to quickly respond to surging market demand.

- Lower Costs and Greater Stability Unlike traditional bank loans or private lending, GAIB’s tokenization model could reduce financing costs and diversify funding sources. By tapping into a global pool of investors, cloud / data centers gain more stability and resilience in a rapidly evolving AI economy.

Why GAIB Matters to Investors

Section titled “Why GAIB Matters to Investors”

- Direct Exposure to AI Compute

Investing in Big Techs such as Meta or Amazon, may seem like a proxy play on AI, but in reality, it means buying into a basket of business lines—advertising, e-commerce, cloud computing, and more—without direct exposure to AI compute economics. GAIB offers investors a more targeted route by tokenizing enterprise-grade GPUs—such as NVIDIA’s H100, H200 or GB200—linking returns directly to GPU-centric reward streams.

- Flexible Financial Strategies

From conservative hedging to higher-risk speculations, GAIB’s integrations with various DeFi protocols creates a range of derivatives and use cases for tokenized GPUs and AID. Whether investors are seeking stable, predictable yields or aiming to exploit market volatility, GAIB lets them tailor their strategies, catering to a spectrum of risk-reward profiles.

AID and SAID are designed to be composable across the DeFi ecosystem. Below are key integration categories and how they can be used:

-

Yield Trading

Integrate with Pendle to split AID and sAID into principal and yield tokens. This allows users to trade fixed or variable yield exposure on secondary markets. -

Liquidity Provision

Pair AID and sAID in stable liquidity pools on Curve or Balancer to provide deep, efficient liquidity while earning trading fees and rewards. -

Collateral in Money Markets

List AID and SAID as collateral on lending protocols like Aave, Morpho, or Spark. Users can borrow stablecoins or ETH against them without selling their positions. -

Restaking and Rehypothecation

Integrate with EigenLayer or Symbiotic to enable AID and sAID to be restaked for additional rewards and security contributions to active validation services. -

RWA and Credit Infrastructure

Collaborate with Centrifuge or Maple to include AID and sAID within real-world asset or private credit lending frameworks, bridging DeFi liquidity to traditional yield sources. -

Stablecoin Collateralization

Use AID and SAID as collateral for synthetic stablecoins such as Frax or Ethena, enabling new stable yield-backed instruments. -

Derivatives and Structured Products

Integrate with Synthetix or Lyra to create yield-enhanced or hedged derivatives built on AID and SAID positions. -

Cross-Chain Liquidity

Expand access through LayerZero or Axelar integrations, allowing AID and SAID to move seamlessly across chains while maintaining liquidity and composability.