AID (mainnet coming soon)

What is AID?

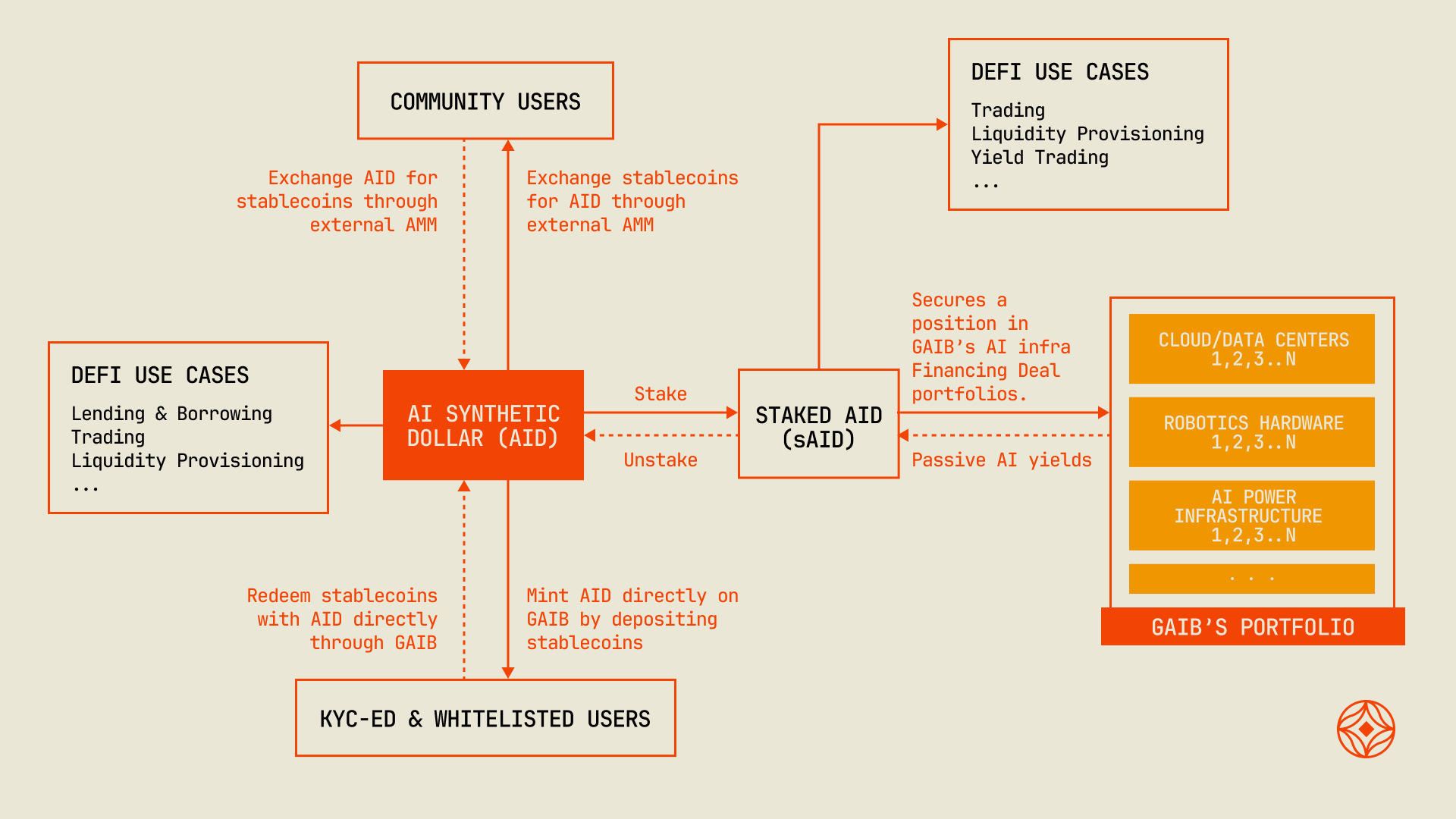

Section titled “What is AID?”AID (AI Synthetic Dollar) is a synthetic dollar fully backed by the U.S. Treasuries and minted 1:1 by depositing USDC, USDT and other accepted stablecoin assets. It’s the first product built on GAIB’s economic layer, an entry point to GAIB’s tokenized portfolio of AI infrastructure, and a base currency in the broader DeFi ecosystem.

How to Acquire AID

Section titled “How to Acquire AID”- Minting: Whitelisted users can mint AID by depositing USDC, USDT, or other supported stablecoins through the GAIB AID minting contract.

- Swapping: Regular users can acquire AID by exchanging stablecoins on leading DEXes.

How to Exit AID

Section titled “How to Exit AID”- Whitelisted users can redeem AID for underlying collateral (USDC, USDT and other accepted stablecoin assets) via the GAIB AID redemption contract

- For regular users, AID can be exchanged for USDC, USDT and other stablecoin assets on leading DEXes.

What Can You Do with AID

Section titled “What Can You Do with AID”- Staking: Users can stake AID to receive sAID, a liquid, yield-bearing fund token representing shares in GAIB’s portfolio. Yield accrues via a floating exchange rate between sAID and AID, allowing stakers to benefit from the growth in the underlying assets.

- Lending and Borrowing: GAIB will integrate with major lending protocols to let users deposit AID into lending pools and earn additional returns. Borrowing will also be possible, enabling users to lock major cryptocurrencies as collateral and borrow AID against them.

- Trading: A variety of trading pairs will be introduced, pairing AID with other major currencies. By positioning AID as a base currency, GAIB aims to facilitate seamless swaps and easy management of trading positions.

- Liquidity Provisioning: GAIB incentivizes users to supply AID liquidity in AMM pools. Liquidity providers earn fees and receive GAIB token incentives, making this an attractive way to support the ecosystem and generate income.

What is sAID (staked AID)?

Section titled “What is sAID (staked AID)?”sAID (staked AID) is a receipt token representing a share in a tokenized portfolio of AI infrastructure financing deals. sAID is not pegged to US$1.00, but rather represents the net asset value (NAV) of a claim on the portfolio.

How to Acquire sAID?

Section titled “How to Acquire sAID?”sAID fund tokens can be minted only by staking AID, at the prevailing deposit NAV. The sAID Fund’s underlying collateral is deployed into:

- A portfolio of real-world AI infrastructure financing deals; ~ 70%

- A liquidity buffer comprising the U.S. Treasuries; ~30%

When a depositor contributes collateral to the sAID Fund they will be issued sAID, a tradeable LP token. The sAID Fund utilizes the ERC-4626 “Tokenized Vault” Standard, which is used to manage how the sAID token accrues value from the underlying AI infrastructure financing deals. The sAID token itself utilizes the ERC20 token standard and is tradeable on existing DEX infrastructure.

How to Unstake sAID?

Section titled “How to Unstake sAID?”sAID can be unstaked via the GAIB AID staking portal at any time at the sAID Withdrawal NAV sAID unstaking requests will be subject to the withdrawal mechanism.

What Can You Do with sAID?

Section titled “What Can You Do with sAID?”- Earning Rewards: Simply holding sAID entitles users to ongoing rewards, as it is a yield-bearing token backed by real-world AI demand. No additional steps are required to claim these rewards—value accrues automatically over time.

- Trading: GAIB will introduce multiple trading pairs that link sAID with major currencies. This ensures that users can trade sAID for other assets, simplifying trade execution and portfolio management.

- Liquidity Provisioning: Users can supply sAID to AMM pools, earning both transaction fees and GAIB token incentives. By contributing sAID liquidity, participants support the overall ecosystem while generating additional income.

- Principal and Yield Tokens (PT/YT): As a yield-bearing asset, sAID will be integrated into specialized yield-trading protocols such as Pendle. Through these integrations, holders can create or trade Principal Tokens (PT) and Yield Tokens (YT) derived from sAID. They can also provide liquidity for PT or YT pairs.

- Lending and borrowing: GAIB will integrate with leading lending protocols such as AAVE, Morpho, and Euler, to enable sAID holders to borrow major stablecoins such as USDC and USDT against their sAID. This allows them to gain liquidity without exiting sAID positions and compose their own yield strategies, while the underlying collateral continues to accrue value, offsetting part of or all of the borrowing costs and reducing the risks of liquidations.

AID <> sAID

Section titled “AID <> sAID”Dual Exchange Rate System

Section titled “Dual Exchange Rate System”To mitigate the risk of large-scale withdrawals and ensure the stability of the protocol, a dual exchange rate mechanism is employed.

- Deposit Exchange Rate governs the minting of sAID from collateral and does not account for unrealized losses

- Withdrawal Exchange Rate governs redemptions and incorporates unrealized losses. When unrealized losses are present, the Withdrawal Exchange Rate falls below the Deposit Exchange Rate, discouraging premature withdrawals until losses are either realized or recovered.

This mechanism also discourages new deposits in situations of imminent default, ensuring that existing participants bear their proportional share of losses, rather than socializing them with incoming investors.

Calculation of sAID Deposit & Withdraw NAV

Section titled “Calculation of sAID Deposit & Withdraw NAV”Total Supply

Section titled “Total Supply”The total sAID supply equals the sum of all AID staked. It only changes due to minting or redemptions; interest, fees, or unrealized losses do not affect the total supply, but instead impact the numerator of NAV.

Total Asset

Section titled “Total Asset”Total Assets represent the current value of the underlying AI infrastructure financing portfolio, continuously updated based on loan activity, repayments, and unrealized gains or losses.

Deposit NAV

Section titled “Deposit NAV”Determines how much sAID is minted when depositing collateral (AID). Ignores unrealized losses, ensuring a stable minting price.

NAVDeposit=Total AssetTotal Supply

Withdrawal NAV

Section titled “Withdrawal NAV”Determines how much collateral is returned upon redemption. Accounts for unrealized losses, potentially lowering the redemption value to discourage mass withdrawals.

NAVDeposit=Total Asset - Unrealized LossesTotal Supply

Note: sAID Market Price vs. NAV

The sAID NAV may differ from the market price on DEXes. Purchases sAID on a DEX occur at the AMM-determined market price, which may be above, below, or equal to the Deposit NAV depending on supply and demand, gas fees, and arbitrage activities. Deposit NAV only applies when minting sAID directly through the GAIB protocol by staking AID.

sAID Withdrawals

Section titled “sAID Withdrawals”sAID withdrawals operate under a cyclical withdrawal manager model. In this model, withdrawal requests are processed monthly (every 30 days) at the sAID Withdrawal NAV and allocated on a pro-rata basis according to available liquidity.

Withdrawal Cycle and Window

Section titled “Withdrawal Cycle and Window”To participate in a given monthly withdrawal cycle, users must submit requests within the first 7 days of the cycle, known as the Withdrawal Window.

If the total withdrawal requests in a cycle exceed available liquidity, any unfulfilled requests will automatically roll over to the next withdrawal window/cycle until fully processed.

Sources of Withdrawal Funds

Section titled “Sources of Withdrawal Funds”sAID withdrawals can be funded from:

- Undeployed collateral (cash)

- Maturing AI infra financing deals during the withdrawal cycle Incoming

- sAID deposits during the withdrawal cycle

- Liquidation of the 30% treasury buffer

Withdrawal Request Management submitted but unfulfilled withdrawal requests can be modified or canceled via the withdrawal manager module in the user dashboard.

Market Trading Option

Section titled “Market Trading Option”Users may also choose to trade sAID tokens on the market at the current market price to obtain instant liquidity instead of withdrawing. The sAID withdrawal interface provides live information on both redemption and market trading options to help users make informed decisions.

Withdraw Process (3 Steps)

Section titled “Withdraw Process (3 Steps)”1) Request Submission: Users submit withdrawal requests during the current cycle (Cycle N) and can modify or cancel them during this stage.

2) Waiting Period: After submission, users must wait at least one full cycle (Cycle N+1) before their request becomes eligible for withdrawal in the subsequent cycle (Cycle N+2). (i.e. roughly 60 days later)

3) Execution: Users execute their withdrawals during the eligible 7-day exit window.

Request and Locking Phase

Section titled “Request and Locking Phase”Request Recording: By calling requestRedeem(n), users submit their request, and their sAID shares are transferred to the Withdrawal Manager as lockedShares and assigned an exitCycleId. Each user can have only one active request at a time.

Asset Locking: During the next withdrawal window (first 7 days of the cycle), the system continuously locks sufficient assets to satisfy all requests in that window. Locked assets cannot be used for new loans.

Partial Withdrawals

Section titled “Partial Withdrawals”By grouping users into cycles, GAIB ensures that users get a prorated distribution of cash in the event of partial liquidity in the system.

If liquidity is insufficient during a withdrawal window:

- Withdrawals are filled pro rata based on the ratio of each user’s withdrawal request relative to total requested withdrawals outstanding

- Partially unfulfilled requests roll over automatically into the next withdrawal window

Request Updates & Cancellations

Section titled “Request Updates & Cancellations”- Users may refresh, modify, or cancel their request—but only before their eligible withdrawal window starts.

- Any update triggers a new waiting period of at least one full cycle, so the modified request only becomes eligible for withdrawal after two further cycles.